How Long Do Judgement Liens Last In Ohio . Web judgment liens are attached to a debtor’s real property and will remain in effect for five years. Web any judgment or decree rendered by any court of general jurisdiction, including district courts of the united states, within this. A creditor can obtain a judgment. Web the state of ohio can obtain a judgment lien against a taxpayer when a tax has been assessed, but has not been paid. Web a privately held judgment issued in ohio becomes “dormant” five years after the latter of (a) when the judgment. Web (2) except as otherwise provided in division (d) of this section, a judgment in favor of the state, is dormant. Web attorney general's office need only refile a tax lien every 15 years in common pleas court to keep the lien. Web attorney general's office need only refile a tax lien every 15 years in common pleas court to keep the lien operative against the tax.

from www.formsbank.com

Web attorney general's office need only refile a tax lien every 15 years in common pleas court to keep the lien operative against the tax. Web attorney general's office need only refile a tax lien every 15 years in common pleas court to keep the lien. Web judgment liens are attached to a debtor’s real property and will remain in effect for five years. Web a privately held judgment issued in ohio becomes “dormant” five years after the latter of (a) when the judgment. Web (2) except as otherwise provided in division (d) of this section, a judgment in favor of the state, is dormant. Web the state of ohio can obtain a judgment lien against a taxpayer when a tax has been assessed, but has not been paid. A creditor can obtain a judgment. Web any judgment or decree rendered by any court of general jurisdiction, including district courts of the united states, within this.

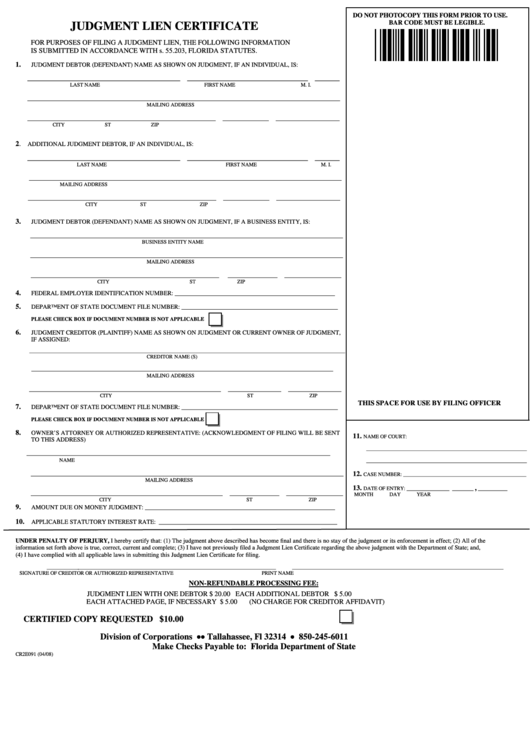

Fillable Judgment Lien Certificate Template printable pdf download

How Long Do Judgement Liens Last In Ohio Web attorney general's office need only refile a tax lien every 15 years in common pleas court to keep the lien. Web attorney general's office need only refile a tax lien every 15 years in common pleas court to keep the lien. Web (2) except as otherwise provided in division (d) of this section, a judgment in favor of the state, is dormant. Web any judgment or decree rendered by any court of general jurisdiction, including district courts of the united states, within this. Web attorney general's office need only refile a tax lien every 15 years in common pleas court to keep the lien operative against the tax. Web a privately held judgment issued in ohio becomes “dormant” five years after the latter of (a) when the judgment. A creditor can obtain a judgment. Web the state of ohio can obtain a judgment lien against a taxpayer when a tax has been assessed, but has not been paid. Web judgment liens are attached to a debtor’s real property and will remain in effect for five years.

From www.signnow.com

Judgment Lien Sample Complete with ease airSlate SignNow How Long Do Judgement Liens Last In Ohio Web judgment liens are attached to a debtor’s real property and will remain in effect for five years. Web a privately held judgment issued in ohio becomes “dormant” five years after the latter of (a) when the judgment. Web attorney general's office need only refile a tax lien every 15 years in common pleas court to keep the lien operative. How Long Do Judgement Liens Last In Ohio.

From www.uslegalforms.com

Release of Judgment Lien Full Release Release Judgment US Legal Forms How Long Do Judgement Liens Last In Ohio A creditor can obtain a judgment. Web a privately held judgment issued in ohio becomes “dormant” five years after the latter of (a) when the judgment. Web (2) except as otherwise provided in division (d) of this section, a judgment in favor of the state, is dormant. Web any judgment or decree rendered by any court of general jurisdiction, including. How Long Do Judgement Liens Last In Ohio.

From www.templateroller.com

Cuyahoga County, Ohio Request for Filing Certification of Judgment Lien How Long Do Judgement Liens Last In Ohio Web attorney general's office need only refile a tax lien every 15 years in common pleas court to keep the lien. Web attorney general's office need only refile a tax lien every 15 years in common pleas court to keep the lien operative against the tax. Web the state of ohio can obtain a judgment lien against a taxpayer when. How Long Do Judgement Liens Last In Ohio.

From www.garybuyshouses.com

What are Judgement Liens in Simple Terms How Long Do Judgement Liens Last In Ohio Web attorney general's office need only refile a tax lien every 15 years in common pleas court to keep the lien operative against the tax. Web any judgment or decree rendered by any court of general jurisdiction, including district courts of the united states, within this. Web a privately held judgment issued in ohio becomes “dormant” five years after the. How Long Do Judgement Liens Last In Ohio.

From www.signnow.com

Full or Partial Release of Judgment Liens by Judgment Form Fill Out How Long Do Judgement Liens Last In Ohio Web the state of ohio can obtain a judgment lien against a taxpayer when a tax has been assessed, but has not been paid. Web any judgment or decree rendered by any court of general jurisdiction, including district courts of the united states, within this. Web a privately held judgment issued in ohio becomes “dormant” five years after the latter. How Long Do Judgement Liens Last In Ohio.

From www.youtube.com

Judgments and liens How they affect loan process YouTube How Long Do Judgement Liens Last In Ohio Web judgment liens are attached to a debtor’s real property and will remain in effect for five years. Web the state of ohio can obtain a judgment lien against a taxpayer when a tax has been assessed, but has not been paid. Web attorney general's office need only refile a tax lien every 15 years in common pleas court to. How Long Do Judgement Liens Last In Ohio.

From printableformsfree.com

Acknowledgement Of Satisfaction Judgment Ca Form Fillable Printable How Long Do Judgement Liens Last In Ohio Web a privately held judgment issued in ohio becomes “dormant” five years after the latter of (a) when the judgment. Web judgment liens are attached to a debtor’s real property and will remain in effect for five years. Web the state of ohio can obtain a judgment lien against a taxpayer when a tax has been assessed, but has not. How Long Do Judgement Liens Last In Ohio.

From wronadamslaw.com

Legal Options Explained to Navigate Judgment Liens How Long Do Judgement Liens Last In Ohio Web (2) except as otherwise provided in division (d) of this section, a judgment in favor of the state, is dormant. Web any judgment or decree rendered by any court of general jurisdiction, including district courts of the united states, within this. A creditor can obtain a judgment. Web a privately held judgment issued in ohio becomes “dormant” five years. How Long Do Judgement Liens Last In Ohio.

From www.uslegalforms.com

Collin Texas Release of Judgment Lien Abstract of Judgment US Legal How Long Do Judgement Liens Last In Ohio Web a privately held judgment issued in ohio becomes “dormant” five years after the latter of (a) when the judgment. Web (2) except as otherwise provided in division (d) of this section, a judgment in favor of the state, is dormant. Web attorney general's office need only refile a tax lien every 15 years in common pleas court to keep. How Long Do Judgement Liens Last In Ohio.

From www.scribd.com

Sample Motion for Summary Judgment by Defendant in United States How Long Do Judgement Liens Last In Ohio Web attorney general's office need only refile a tax lien every 15 years in common pleas court to keep the lien operative against the tax. Web judgment liens are attached to a debtor’s real property and will remain in effect for five years. Web the state of ohio can obtain a judgment lien against a taxpayer when a tax has. How Long Do Judgement Liens Last In Ohio.

From www.dochub.com

How to remove a mechanics lien in ohio Fill out & sign online DocHub How Long Do Judgement Liens Last In Ohio Web any judgment or decree rendered by any court of general jurisdiction, including district courts of the united states, within this. A creditor can obtain a judgment. Web attorney general's office need only refile a tax lien every 15 years in common pleas court to keep the lien. Web (2) except as otherwise provided in division (d) of this section,. How Long Do Judgement Liens Last In Ohio.

From www.hauseit.com

How Long Does a Lien Stay On Your Property? Hauseit® NY & FL How Long Do Judgement Liens Last In Ohio Web any judgment or decree rendered by any court of general jurisdiction, including district courts of the united states, within this. A creditor can obtain a judgment. Web the state of ohio can obtain a judgment lien against a taxpayer when a tax has been assessed, but has not been paid. Web a privately held judgment issued in ohio becomes. How Long Do Judgement Liens Last In Ohio.

From www.megadox.com

Ohio Conditional Waiver and Release of Lien on Final Payment Legal How Long Do Judgement Liens Last In Ohio Web the state of ohio can obtain a judgment lien against a taxpayer when a tax has been assessed, but has not been paid. Web a privately held judgment issued in ohio becomes “dormant” five years after the latter of (a) when the judgment. A creditor can obtain a judgment. Web attorney general's office need only refile a tax lien. How Long Do Judgement Liens Last In Ohio.

From www.ezsellhomebuyers.com

Understanding Property Liens in Ohio Duration & Implications How Long Do Judgement Liens Last In Ohio Web (2) except as otherwise provided in division (d) of this section, a judgment in favor of the state, is dormant. Web attorney general's office need only refile a tax lien every 15 years in common pleas court to keep the lien operative against the tax. Web judgment liens are attached to a debtor’s real property and will remain in. How Long Do Judgement Liens Last In Ohio.

From wfgagent.com

Judgement Liens WFG Agent How Long Do Judgement Liens Last In Ohio Web (2) except as otherwise provided in division (d) of this section, a judgment in favor of the state, is dormant. Web a privately held judgment issued in ohio becomes “dormant” five years after the latter of (a) when the judgment. Web any judgment or decree rendered by any court of general jurisdiction, including district courts of the united states,. How Long Do Judgement Liens Last In Ohio.

From www.deeds.com

How Does a Judgment Lien Work? Our Succinct Guide to Judicial Liens on How Long Do Judgement Liens Last In Ohio Web the state of ohio can obtain a judgment lien against a taxpayer when a tax has been assessed, but has not been paid. Web attorney general's office need only refile a tax lien every 15 years in common pleas court to keep the lien operative against the tax. Web any judgment or decree rendered by any court of general. How Long Do Judgement Liens Last In Ohio.

From www.pdffiller.com

Fillable Online Release of Judgment Lien Fax Email Print pdfFiller How Long Do Judgement Liens Last In Ohio Web the state of ohio can obtain a judgment lien against a taxpayer when a tax has been assessed, but has not been paid. Web attorney general's office need only refile a tax lien every 15 years in common pleas court to keep the lien. A creditor can obtain a judgment. Web any judgment or decree rendered by any court. How Long Do Judgement Liens Last In Ohio.

From mechanicslien.com

How Long Does a Lien Last? National Lien & Bond How Long Do Judgement Liens Last In Ohio Web judgment liens are attached to a debtor’s real property and will remain in effect for five years. Web a privately held judgment issued in ohio becomes “dormant” five years after the latter of (a) when the judgment. Web attorney general's office need only refile a tax lien every 15 years in common pleas court to keep the lien operative. How Long Do Judgement Liens Last In Ohio.